Why Financial Sector Risks Of Ransomware Attacks Are Growing

The world has seen a marked increase in the frequency and intensity of cyberattacks in recent years. While ransomware attacks are not new, their prevalence has grown substantially.

Financial institutions are particularly at risk because of the value of the data they store and the services they offer. If attacked, financial institutions also have a high risk of brand damage.

This article discusses three main reasons why the financial sector is becoming more vulnerable to ransomware attacks. Read on to learn more.

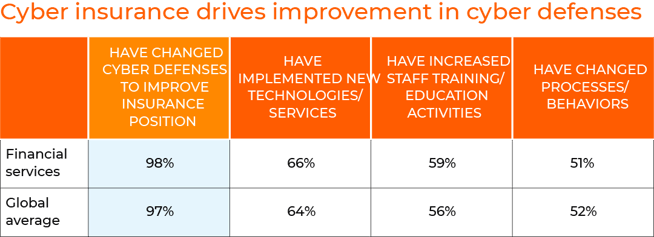

Average Files, Folders, and sensitive files for financial services companies

Source: VARONIS DATA RISK REPORT (FINANCIAL SERVICES)

An Increase in the Quantity of Sensitive Data

Most ransomware attacks are targeted. The perpetrators of targeted attacks will spend considerable time researching their targets and will try to exploit any possible vulnerabilities.

This means that the higher the amount of sensitive data a company holds, the more likely it is to become a victim. Consequently, financial institutions are particularly at risk because of the high value of the data they store and the services they offer.

This data includes highly sensitive customer information, such as their creditworthiness and financial standing.

The financial industry also uses a lot of paper and manual processes that are not digitized, which also makes organizations more susceptible to data loss.

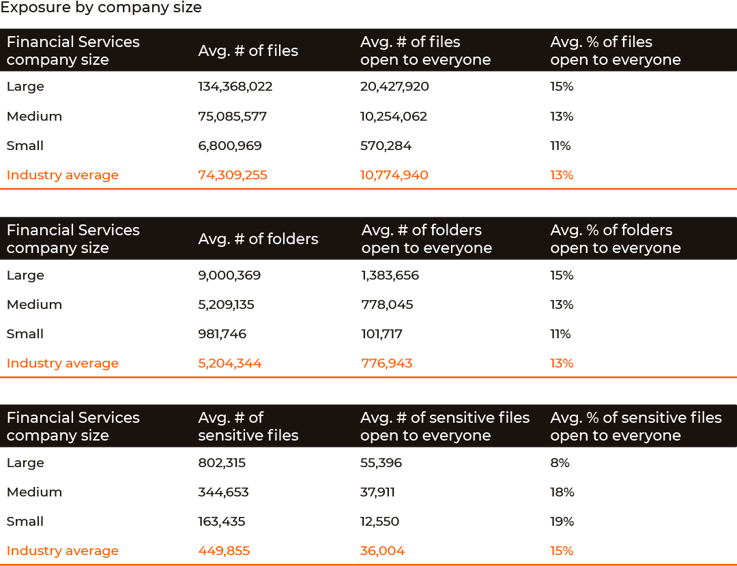

Source: VARONIS DATA RISK REPORT (FINANCIAL SERVICES)

Lack of Compliance and Security Awareness

Many organizations that have never been hit by a ransomware attack have nonetheless implemented security measures to protect against such an attack.

Organizations that have been victims of ransomware attacks are often shocked and may implement stronger security measures to prevent a reoccurrence. However, there is no guarantee that organizations that have been attacked will be more careful in the future.

Many studies have shown that organizations that have been hit once are often hit again because they do not sufficiently raise their awareness of the risks and implement appropriate security measures.

This means that the organizations most at risk of a repeat attack are those that have been attacked and have insufficiently implemented changes to prevent a reoccurrence. Financial institutions are a prime example of such an organization.

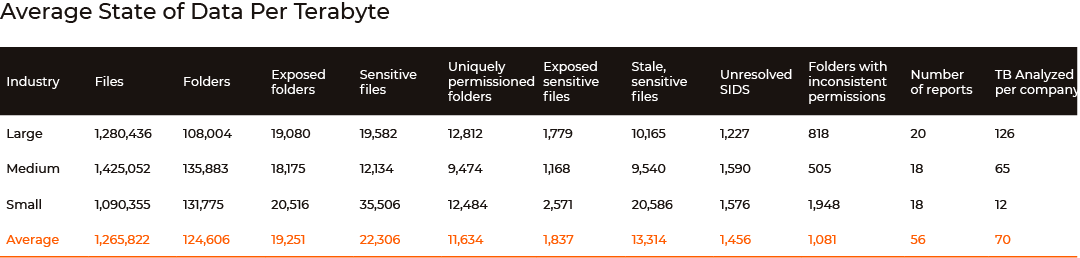

Source: IBM data breach report for 2022

Source: IBM data breach report for 2022

Growing Incidence of Internal Fraud

An increasingly common cause of ransomware attacks is fraud committed by employees. The motivation for these attacks is usually financial, and it is not uncommon for perpetrators to be either dismissed or change jobs soon.

This means that it can be difficult to detect and prosecute fraudulent employees. Consequently, when attacked, financial institutions often have no option but to pay the ransom.

They may also be less likely to report such attacks, meaning the public and the media are less likely to be aware of them.

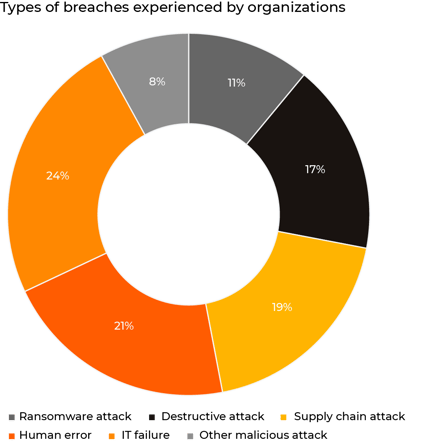

Source: IBM data breach report for 2022

Case Study in the Financial Sector Involving Ransomware

This is a case study that is going to talk about a ransomware attack in the financial sector. It will discuss how the attack has affected the company and its customers and what can be done to prevent such incidents from happening again.

The ransomware attack on the financial institution was discovered on March 21, 2018, when an employee of the company opened an email attachment containing malicious code.

The employee had not followed standard security procedures and clicked on a link in an email that was sent by someone he knew personally.

The First American Company discovered that 885 million customer records were publicly available in May 2019. According to reports, this was the biggest data breach in the financial sector.

How to Combat Ransomware for the Financial Sector

Ransomware is a type of malware that encrypts important data on infected computers and then demands money to decrypt the data.

Ransomware is usually installed on a victim’s computer when they open an email attachment or click on a malicious link.

It can be difficult for companies to protect themselves against ransomware. To fight this, they need to keep their operating systems and applications up-to-date, use anti-malware software, and have regular backups of data stored offsite.

Many companies are now implementing two-factor authentication for employees, which means they will need another form of identification besides their username and password before logging in to their work accounts.

Conclusion

There are many reasons why the financial sector is increasingly vulnerable to ransomware attacks. This includes an increase in the quantity of sensitive data, a lack of compliance and security awareness, and a growing incidence of internal fraud. However, though ransomware attacks are more likely to occur in the financial sector than in other industries, they cannot be dismissed as an unlikely event.

Financial institutions need to be aware of the risks and prepare for them, as the impact of a ransomware attack is likely to be much more significant for a financial institution than for another type of organization.

Subscribe Our Blog

Post By Topic

- Cyberattacks (5)

- Cybersecurity (5)

- Data Protection (4)

- Disaster Recovery Plan (4)

- Backup (3)

- Business continuity (3)

- Data Management (3)

- Ransomware (3)

- Ransomware attacks (3)

- Malware (2)

- Phishing (2)

- Recovery Profiles (2)

- AXCELIOS (1)

- Air Gapped System (1)

- Anomaly Detection (1)

- Automation (1)

- Cloud security threats (1)

- Data (1)

- Data Damage (1)

- Distributed Denial-of-Service (DDoS) attack (1)

- Eavesdropping attack (1)

- IP spoofing (1)

- Passwords (1)

- Phishing emails (1)

- Security AI (1)

Leave Comment